Filter: industrie vastgoed Food & Agri

Interview: Frederique de Jong Schouwenburg, voorzitter van het F&A fonds In gesprek met Frederique (de Bruin) de Jong Schouwenburg; de recent aangestelde voorzitter van de raad van toezicht van Anders Invest Food & Agri fonds De wereld van Food & Agri is voortdurend in beweging en heeft een integrale plaats in het oplossen van grote vraagstukken van deze tijd op zowel sociale als ecologische dimensies. Vandaag spreken we met Frederique (de Bruin) de Jong Schouwenburg, de recent aangestelde voorzitter van de raad van toezicht van Anders Invest Food & Agri Fonds. We zullen met haar de toekomst van de food & agri sector bespreken, haar investeringsfilosofie en visie op leiderschap. Je bent in 1999 afgestudeerd aan de Erasmus Universiteit in Rotterdam met een MSc in economie. Kun je ons een vogelvlucht meenemen in wat er daarna allemaal op je pad is gekomen? ‘Ten eerste, wat leuk dat ik mag aanschuiven voor dit gesprek, ik ben inderdaad afgestudeerd met een MSc in economie. Daarna ben ik mijn carrière begonnen bij Van Lanschot Kempen. Daar heb ik het traineeship gevolgd, hartstikke leuk en onwijs leerzaam. Na mijn traineeship ben ik gaan werken voor een investeringsmaatschappij. Indofin is een single-family office (SFO). Ik ben verantwoordelijk voor de vastgoedportefeuille, waaronder een landelijke (agrarisch en bosbouw) portfolio. Zo ben ik ook in aanraking gekomen met de Food & Agri Sector.’ En daarna? ‘Op mijn 29e kreeg ik de kans om als 'bijzitter' deel te nemen aan het College van Gedelegeerden van de Koninklijke Maatschap Wilhelminapolder, een groot landbouwbedrijf in Zeeland. Door deze rol kwam ik voor het eerst in aanraking met governance en het houden van toezicht op een onderneming. Toen er later onrust ontstond in de Maatschap en het volledige college aftrad, werd mij de gelegenheid geboden om aan te blijven voor de continuïteit. Zo maakte ik op relatief jonge leeftijd de overstap naar een raad van toezicht.’ Daarna heb ik toezichthoudende functies gehad bij natuurmonumenten en de stichtingen van het Sophia kinderziekenhuis. Bij beide heb ik mijn volle termijnen van twee keer vier kaar volgemaakt, dat was zo ontzettend leuk om te doen. Recentelijk kwam eigenlijk Anders Invest met het Food & Agri fonds, en daarom zitten we nu hier dit leuke gesprek te voeren.’ Wat waren andere carrièremogelijkheden die je ambieerde? ‘Weet je, als ik terugkijk, heb ik altijd een sterke affiniteit gevoeld met maatschappelijke kwesties, en dat is eigenlijk nooit veranderd. Dat zie je ook terug in mijn functies als toezichthouder. Ik geloof echt dat er meer is dan alleen cijfers en geld; het gaat ook om maatschappelijk iets betekenen. Stiekem heb ik dat altijd wel gedaan, maar als ik het over zou doen, zou ik waarschijnlijk nog meer de kant van Ngo's opgegaan zijn, met natuurlijk ook een scherpe financiële blik.’ Hoe probeer je wat bij te dragen aan deze wereld? ‘Wat mij altijd heeft geboeid is het creatief combineren van economie met maatschappelijke problematiek. Ik ben ervan overtuigd dat voor de langetermijnoplossing van problemen economische dragers essentieel zijn. Het gaat er om die dragers te vinden, die win-winsituaties waarbij initiatieven zichzelf kunnen onderhouden. Dat is waarvoor ik midden in de nacht kan opstaan, onwijs boeiend! Ook geloof ik niet in de duurzaamheid van subsidies; als iets financieel voortdurend ondersteund moet worden, dan heeft het geen toekomst. In de huidige discussie over duurzaamheid vind ik dit bijzonder interessant. Waar zijn die win-winsituaties? Hoe combineer je duurzaamheid met economie op zo'n manier dat het ook economisch haalbaar is? Ja, dat is wat mij graag bezighoudt.’ Hoe zie jij jouw rol en de rol van Anders Invest hierin? ‘Allereerst, mijn rol als voorzitter van een Raad van Advies is het leiden van plenaire vergaderingen en zorgen voor een effectieve besluitvorming. Dusdanig ben je verantwoordelijk voor het adviseren en ondersteunen van het management of bestuur op strategisch niveau, gebaseerd op de expertise en ervaring van de raadsleden. De benadering van Anders Invest spreekt mij erg aan, vooral vanwege hun focus op impact en langetermijnstrategie. Tijdens onze laatste plenaire vergadering, heb ik opgemerkt hoe belangrijk het is dat de impact intrinsiek voortkomt uit de beleving van de portfolio bedrijven zelf. Dit zie ik bijvoorbeeld terug in het initiatief bij Gebana in Brazilië met het ondersteunen van minderjarige meisjes, om ze een betere kans in het leven te geven en de lokale samenleving hiermee te versterken . Wat ik ook waardeer aan Anders Invest is hun structuur als een open-end fonds, in tegenstelling tot de meeste private equity fondsen die closed-end zijn. Vanuit mijn ervaring met familiebedrijven en family offices, vind ik de langetermijnhorizon die hierbij gehanteerd wordt heel belangrijk. Dit creëert een betere alignment of interest met de portfolio bedrijven, wat leidt tot een andere manier van omgaan met zowel impact als investeringen. Bovendien zorgt de structuur van het fonds ervoor dat investeerders in kleinere porties kunnen instappen, wat resulteert in een grotere diversiteit en betrokkenheid van investeerders. Dit alles maakt Anders Invest bijzonder en onderscheidend in mijn ogen.’ Gezien de grote diversiteit aan investeerders binnen Anders Invest, die elk hun eigen opvattingen hebben, hoe zorg je ervoor dat alle investeerders op één lijn blijven? ‘Om alle investeerders dezelfde kant op te krijgen, is transparantie het allerbelangrijkste, in elke context. Dit geldt zeker voor toezichthoudende of bestuurlijke rollen. Door altijd een helder en eerlijk verhaal te vertellen, transparant te zijn en zaken goed uit te kunnen leggen, kom je heel ver. Dit betekent ook consequent zijn in wat je zegt en doet, vooral in een langetermijnrelatie zoals bij Anders Invest. Bijvoorbeeld, als er iets wordt gezegd in een vergadering, dan moet dat over een half jaar niet te veel afwijken. Consistentie en transparantie zijn essentieel voor het opbouwen van een goede reputatie, wat cruciaal is voor langetermijnrelaties, zelfs met mensen uit verschillende achtergronden.’ Food & Agri is een bijzonder interessante markt met een enorm vermogen tot impact in Nederland, wat zijn de grote thema’s die spelen? ‘De duurzaamheidstransitie is essentieel voor de Food & Agri sector, en het is onmiskenbaar dat dit een grote rol speelt. Het fonds, gericht op de hele 'Farm to Fork'-keten, weerspiegelt dit belang. Ik zie veel potentie in regeneratieve landbouw. Volgens het klimaatakkoord moet de landbouw in 2050 klimaatneutraal zijn. Multinationals zoals Danone, Nestlé en Campina spelen hierop in door te investeren in regeneratieve landbouw. Daarnaast speelt technologie een cruciale rol in de agri-food sector, met ontwikkelingen in artificial intelligence, zoals deep learning machines die efficiënter zijn in het sorteren van producten, en vertical farming. Deze technologieën kunnen helpen de arbeidskosten, efficiëntie en de houdbaarheid van producten. Ik zie deze technologieën niet alleen als enablers voor duurzaamheid, maar ook als belangrijke trends op zich. Ik verheug me ontzettend op het evenement in Bilbao in april, Food for Future, waarbij alle nieuwe technologische ontwikkelingen aan bod komen, onwijs interessant.’ Hoe zie jij je rol als lid van de raad van toezicht bij Anders Invest? ‘In mijn rol als toezichthouder bij Anders Invest ligt de focus vooral op de bredere overkoepelende aspecten, in tegenstelling tot de dagelijkse leiding. Dit houdt in dat ik me niet direct bezighoud met het managen van de portfolio ondernemingen, maar meer met de strategische en bestuurlijke kant.’ Hoe ziet het leiderschap van de toekomst eruit? ‘Ik ben een voorstander van het betrekken van jonge commissarissen en toezichthouders zoals dat toentertijd gebeurde met mijn rol als bijzitter. Er gebeurt veel in het governance spectrum en de problematiek en innovaties zijn ingewikkeld, diversiteit in de samenstelling van een RvT is belangrijker dan ooit. Dit gaat verder dan alleen man-vrouw verschillen. Het omvat ook generatieverschillen. Jonge generaties hebben bijvoorbeeld vaak een andere kijk op duurzaamheid, technologie, data, etc... Het is belangrijk om verschillende generaties te betrekken, om te begrijpen wat er speelt en wat er leeft. Wil je nog iets toevoegen aan het gesprek als slotzin? ‘Anders Invest, als een 'evergreen'-fonds, biedt langetermijngroei van private ondernemingen en flexibiliteit. Dit is aantrekkelijk voor family offices en private investeerders en biedt een uniek product in de markt. We moeten deze aspecten benadrukken en er trots op zijn. Door investeerders te betrekken bij onze investeringen, creëren we een band en voegen we echte waarde toe.’

21 maart 2024

Generational Gastronomy: Understanding Unique Eating Habits This article is part of a series of short blogs by the Food & Agri team of Anders Invest. Here, we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. In this piece, we delve into the various generations: Baby Boomers (born between 1946-1964), Gen X (born between 1965 and 1980), Millennials (born between 1981 and 1996), and Gen Z (born between 1997 and 2012). What makes their eating behavior unique? And what trends and similarities emerge? Health: A Cultural Shift Health is a universal value, but the way different generations approach it varies significantly. For Baby Boomers healthy eating is central, especially because they are becoming older and are developing age-related ailments. Therefore, they see food as a way to improve their quality of life and stay healthy for longer. When looking at the advantages Baby Boomers want to gain from food, these mostly relate to reducing the risk of diseases like cardiovascular disease and cancer. In order to achieve this, the Baby Boomers in are likely to focus on natural foods and are motivated to practice what they preach in terms of maintaining a healthy diet. While Gen X also sees healthy eating as central and wants to improve their quality of life to stay healthy longer, Gen X’s approach is slightly different and is focused on having a healthy weight and following weight loss diets more than other generations. In contrast, Millennials and Gen Z are more aware of a holistic approach to health, where mental health is seen as equally important as physical health, which can for example be explained by the fact that these two younger generations report to experience more stress and mental health issues than Gen X and Baby Boomers. In practice, this means that Millennials and Gen Z are becoming more aware of the link of e.g. sugary foods to depression or of caffeine excesses to anxiety, thus leading them to avoid such foods. Furthermore, their holistic view also means that a big part of Millennials and Gen Z believe that a healthy diet is about more than calorie counting and following restricting diets. For example, many people within these generations believe that calorie counts on food packaging can have a bad effect on mental health. Though Millennials and Gen Z thus view health as having both a physical and mental component, there are also some differences in their attitudes towards food. Millennials on one hand, prefer fresh and unprocessed foods and are the biggest buyers of fortified foods, so foods with added vitamins and minerals. For Gen Z, one of the most important benefits they seek from food is to improve their sleep and downtime. Dining Out: The Evolution of Dining Experiences The restaurant landscape is undergoing a transformation driven by the preferences of different generations. While Baby Boomers and Gen X prefer rare but luxurious dinners with more traditional tastes and dining concepts, with gen X sometimes enjoying personalized twists to well-known meals. Millennials and Gen Z focus more on the experience and social aspect. Convenience is also paramount for these two generations. Gen Z and Millennials are aptly dubbed the convenience generations, and this concept aligns well with their dining preferences: they seek accessible moments of enjoyment that fit their busy lifestyles. They spend significantly more on dining out than older generations, but simultaneously have a smaller disposable income. This explains the growing popularity of affordable and informal dining establishments among Millennials and Gen Z. Engagement: Food for Thought An notable trend among Millennials and Gen Z specifically, is their increasing engagement with the societal impact of food. While all generations indicate that they consider this important, Millennials and Gen Z clearly place the most value on this. For Gen Z, food even is a way to express themselves; the majority says that the food they consume is indicative of who they are and that they can use food to show their identity and beliefs. They value transparency, sustainability, and social responsibility in the brands they support and want to know their food choices have a positive impact on the world around them. This also greatly influences the loyalty they feel towards a brand, as a large portion of these two generations expresses willingness to pay more for a company that makes a positive impact. Their loyalty directly translates to the problems Millennials and Gen Z view in the world and their relationship towards food. Gen Z for example, is most worried about the environment and climate change, followed by Millennials. In this case, it is interesting that Millennials have more positive ideas towards the impact they can make, as they are most likely to believe that their food choices have an impact on the environment. Another slight difference between Millennials and Gen Z is that Millennials have an additional preference for smaller brands, while Gen Z supports brands that reciprocate their personal values, regardless of size. Digital savviness: Finding Balance in Food Choices Digital culture plays an increasingly large role in eating behavior, which is especially the case among Millennials and Gen Z: from restaurant reviews to nutritional information to new recipes, they use social media both to gain and share food-related information, like new recipes from different cultures to sharing pictures of their food online. Gen Z mostly turns to social media like Instagram and TikTok to gain advice on for example healthy eating, as they feel like they lack information from the government, educators and the food industry. Millennials on the other hand also use social media, but tend to put more trust in online apps and tools to help them improve their diet and physical wellbeing. A downside of social media and the constant influx of information is that Gen Z in particular, can feel overwhelmed, also when it comes to food. They want to consume food that looks good on pictures, while also being sustainable, ethical and socially conscious and if possible healthy. This leads to people in this generation often struggling to make, what they feel, is the right choice. Companies that can provide clarity in this regard, will therefore be ahead with Gen Z. Each Generation Has a Unique Need These food trends demonstrate how the Food & Agri sector is adapting to the changing preferences and values of different generations. It's clear that there's no one-size-fits-all approach; successful companies will need to adjust to the unique needs of each generation, whether it's related to health or engagement and whether it is inside the house, or out (and about).

15 maart 2024

Op weg naar duurzame voeding: Wim Soetendaal van Star Food over meelwormen voor mensen Dit artikel maakt deel uit van een serie LinkedIn interviews door het Anders Invest Food & Agri team. Hierbij kijken we naar de mensen en activiteiten binnen onze portfolio bedrijven. In dit interview gaan we in gesprek met Wim Soetendaal, oprichter van Star Food. Star Food kweekt verscheidene insecten; van origine voor de hengelsport en diervoeder, maar inmiddels wordt ook voor humane voeding gekweekt. Star Food heeft hiervoor een locatie in Hongarije waar meelwormen worden gekweekt die in voeding worden verwerkt. Beginjaren en overstap naar humane voeding Wim Soetendaal begon in 1985 met het kweken van wormen voor de hengelsport en twee jaar later kwamen hier meelwormen, sprinkhanen en krekels bij. Hier kwam Star Food uit voort, een bedrijf dat gespecialiseerd is in het kweken van insecten voor diervoeder, maar waar inmiddels ook stappen worden gezet om insecten voor humane consumptie mogelijk te maken. In het begin heeft Wim veel zelf uit moeten vinden over de kweek van insecten: “Ik ben veel gaan observeren: wat doet een insect en waarom gedraagt hij zich vandaag anders dan morgen? Ik heb het mezelf eigen gemaakt en geoptimaliseerd – dit doe ik met veel plezier. Het automatiseren en ontwikkelen van de kweek, vind ik nog steeds het leukste om te doen.” De stap naar humane consumptie is van belang, aangezien de eiwittransitie onomkeerbaar is en er wordt gezocht naar duurzame en gezonde eiwitbronnen voor zowel mens als dier. “Insecten zijn en van de meest duurzame eiwitbronnen die er zijn en zijn daarnaast gezond.” Wim vertelt verder: “Je hebt voor bijvoorbeeld een koe veel meer landoppervlakte, voer en water nodig dan voor deze insecten. Op die manier kunnen we dus meer kilo’s insecten kweken op een vierkante meter dan we koeien kunnen houden.” Daarnaast zijn meelwormen voedzaam en bevatten ze alle essentiële aminozuren die het lichaam zelf niet kan maken. Veranderende markt Wim ziet de markt voor meelwormen veranderen: “De ontwikkeling gaat snel: vroeger begon je met kippen ook klein en inmiddels heb je megastallen. Zo is het met insecten ook, het is meer een product geworden en is daardoor meer opgeschaald.” Het belangrijkste voor de toekomst zal hierbij zijn dat de meelwormen tegen de juiste kostprijs worden geproduceerd en met goede kwaliteit. Het product moet consistent zijn qua voedingswaarde en moet genoeg eiwit bevatten. Daarnaast is het belangrijk om consumenten aan het product te binden, waarbij de angst die men in het Westen vaak heeft om insecten te eten volgens Wim vaak tussen de oren zit. De eerste stap wordt hierbij om de meelwormen als ingrediënt te vermarkten, in plaats van als volledig insect. Op die manier kunnen er verschillende soorten voeding van worden gemaakt: van burgers tot shakes en sportdranken. Een belangrijke aanvulling die Wim hierbij plaatst, gaat om de verrijking van het eiwit: “de processing van de meelworm is ontzettend belangrijk. Van origine hebben deze insecten zo’n 35% eiwit. Door de verwerking verrijken we dit naar 80%, waarmee het gelijkwaardig wordt aan bestaande eiwitbronnen als melkeiwit.” Wetgeving en toekomstperspectief Wat betreft het verwerken van de meelwormen zodat ze geschikt zijn om in humane voeding te worden verwerkt, zijn er een aantal hordes te nemen. Met name de regelgeving en het uitvaardigen van zogenaamde Novel Food Dossiers gaat hierin langzaam en neemt veel geld en tijd in beslag. Hierdoor zijn producenten en verwerkers huiverig om grote investeringen te doen, aangezien er een risico is dat een dossier niet wordt goedgekeurd, of dat wetgeving verandert. Desalniettemin worden bij Star Food goede stappen gezet voor de toekomst: “Op onze locatie in Hongarije worden op grote schaal meelwormen gekweekt, nu al zo’n 15 ton per week. We werken eraan deze processen nog meer te verbeteren en kijken naar mogelijke samenwerkingen.” Zo legt Wim uit. “Het is zeker dat insecten een belangrijke rol gaan spelen in food en feed.” Op de vraag of Wim verwacht dit zelf nog mee te maken, geeft hij dan ook een overtuigd bevestigend antwoord.

12 januari 2024

Net-Zero Emissions: Driving Change in Food & Agri This article is part of a series of short LinkedIn blogs by the Food & Agri team of Anders Invest. Here, we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. Considering reducing your carb intake? While some individuals vouch for its effectiveness, others view it as a passing trend in nutrition. In contrast, reducing carbon emissions is a shared objective that unites the global food system. Unless we minimize CO2, methane, and other greenhouse gas (GHG) emissions, sea levels will rise, and the likelihood of catastrophic weather events will increase, impacting the food and agricultural industry.This article will examine the carbon market and will focus on Origin & Amsterdam, a portfolio company of ours, known for its sustainable sourcing and trading. Food plays a crucial role in combating climate change, encompassing factors such as dietary choices, agricultural practices, and the supply chain that connects producers to consumers. Achieving the 1.5-degree target necessitates a reduction of global greenhouse gas emissions, with a goal of reaching a 50 per cent reduction from current levels by 2030 and attaining carbon neutrality by 2050. The framework to achieve these global targets in the food and agricultural industry is outlined in initiatives like the Green Deal. Consequently, the number of companies committed to reaching net-zero emissions has surged globally, with those taking action on such corporate targets quadrupling since 2020—from approximately 1,000 in 2020 to more than 4,000 in January 2023. In this transition towards a net-zero economy, the role of carbon offsetting will be crucial. The carbon market can take two different but not mutually exclusive paths: a compliance carbon market and a voluntary carbon market. In the European Union, the compliance carbon market operates under the EU Emissions Trading System (ETS), a cap-and-trade system designed to limit greenhouse gas emissions across the continent. Under the EU ETS, the European Commission sets an overall emissions cap, which represents the maximum allowable emissions within the EU's jurisdiction, covering key sectors such as power generation, manufacturing, and aviation. This cap is progressively reduced over time to align with the EU's climate targets. Companies receive or purchase emission allowances within this cap, and if they emit less than their allowance, they have the right to sell their surplus permits to others. The price of permits has experienced significant growth. In 2018, a permit was valued at €7.50, while by March 2023, it peaked at over €100. Therefore, this can be a powerful tool and mechanism to incentivize companies to innovate and reduce their emissions. On the other hand, a voluntary carbon market uses carbon credits: a document representing the equivalent of one metric ton of carbon dioxide and other greenhouse gases, either prevented from being emitted into the atmosphere (emissions avoidance/reduction) or extracted from the atmosphere through a carbon-reduction project. This market could lead to emission avoidance/reduction in the short term by investing in green energy, energy-saving technologies, and natural resources. Secondly, it can lead to emission removal (negative emissions). Achieving net-zero emissions by 2050 will require at least five gigatons of negative emissions annually. The voluntary and compliance carbon markets face challenges related to measurement, standardized rules and regulation, leakage, and uncertainty. However, there are promising opportunities to make an impact within the food and agricultural industry. Future developments may enable the financial compensation of sustainable practices, reforestation efforts, and carbon sequestration processes. Companies that lead the way with innovative and environmentally friendly approaches are more likely to benefit from these opportunities. Consequently, investing in companies that actively remove and reduce emissions aligns with our investment philosophy and strategy, making both financial and moral sense. Michel Beekwilder of Origin & Amsterdam, a company from our portfolio specializing in sustainable sourcing and B2B trading of organic products like wheat, spelt, sunflower seeds, soybeans, nuts and vegetable oils, explains what role the carbon market will play in his pursuit of a more sustainable enterprise: "Every organization, regardless of size, will soon need to adhere to forthcoming regulations on environmental impact. We've established benchmarks and performed an internal materiality analysis to remain proactive and not merely reactive. Given our rapid expansion and dependence on the emissions from our logistics partners, a mere commitment to reducing CO2 isn't adequate. Instead, we prioritize partnerships with entities that utilize renewable and hydrogen-based fuels. Our goal is a 30% reduction in average emissions from transport of our products over the next five years. Any gaps in achieving this will be addressed through carbon offset purchases." "Aligning with our mission to create a positive impact, this approach also presents a strong business case. By 2024, major corporations will be mandated to detail their impact via CSRD, tracing back through their value chain to illustrate the nature of the products they acquire and sell. Consequently, these corporations will likely collaborate with sourcing firms with comprehensive impact reports and lead the way in sustainable policy. Moreover, by investing a premium, they can endorse their items with a carbon-neutral label, enhancing their product's value. We expect that customers who strive for transparency and sustainability will want to work with us. This shift is already happening, and making the right strategic decisions now will enable Origin & Amsterdam to be future-proof and acquire plenty of new business."

30 november 2023

Innovatie en Duurzaamheid in Verpakkingen: Een Interview met Klaas Hoving van Horizon Natuurvoeding Dit artikel maakt deel uit van een serie LinkedIn interviews door het Anders Invest Food & Agri team. Hierbij kijken we naar de mensen en activiteiten binnen onze portfolio bedrijven. In dit interview gaan we in gesprek met Klaas Hoving, werkzaam bij Horizon Natuurvoeding. Horizon produceert biologische notenpasta’s evenals verpakte noten en gedroogde zuidvruchten. Deze worden door heel Europa verkocht in biospeciaalzaken onder de merken: Horizon, Monki, Jori en Krekeltje. Dit jaar bestaat Horizon 45 jaar en dat wordt onder andere gevierd met de lancering van een nieuwe verpakkingslijn. Nieuwe verpakkingslijn Klaas Hoving is als Marketing & Benelux Sales specialist al zo’n 11 jaar werkzaam bij Horizon. Horizon zet steeds meer in op product innovaties, met als meest recente de hernieuwde manier van verpakken van de biologische noten, zaden en zuidvruchten. “Met de nieuwe verpakkingslijn zorgen we ervoor dat onze producten nog beter zichtbaar zijn in de schappen van biologische, natuurvoedingswinkels en speciaalzaken. De noten, zaden en zuidvruchten zullen worden in IJsselstein verpakt in quadroseal/stazakken, waarmee de presentatie wordt verbeterd.” Voor Horizon is de verpakking dus een verbetering, maar, zo legt Klaas uit, ook de klanten en winkeliers met wie is gesproken over de stazakken zijn erg positief. Flexibele en dynamische productontwikkeling Buiten dat de producten van Horizon door de stazakken beter presenteren in biospeciaalzaken en consumenten deze dus ook makkelijker kunnen vinden, zijn er meer voordelen aan de veranderde verpakkingslijn. Zo geeft Klaas aan dat, waar Horizon de noten, zaden en vruchten al zelf importeerde en bewerkte, het verpakken van het product daar nu bij is gekomen. “We hebben het productieproces nog meer in eigen beheer, nu we zelf ook in staat zijn te verpakken. Dit maakt ons ook een stuk dynamischer en efficiënter in onze productontwikkeling.” Daarnaast bieden de stazakken mogelijkheden om klanten en eindgebruikers in verschillende landen beter te helpen. “Het hele proces – van de bulk tot het uiteindelijke verpakte product kan nu bij ons worden neergelegd. Hiermee leveren wij een totaalpakket en op termijn zien wij zeker mogelijkheden onze klanten nog beter te ontzorgen. Ook prijstechnisch kan dit voor klanten voordelen hebben”. Daarnaast geeft de nieuwe lijn ook een goede reden om te kijken naar de verpakkingsmaterialen die werden gebruikt en hiervan de duurzaamheid te verbeteren. Horizon is, zo legt Klaas uit, uitgekomen bij een verpakking van 100% polypropyleen en deze is daarmee volledig recyclebaar. De verpakkingen worden vervolgens vervoerd in kartonnen dozen en ze worden gesloten met kartontape, duurzamer dan het plastic tape dat eerst werd gebruikt. Zo zorgt Horizon ervoor dat hun waarden in elke stap van de keten terugkomen – zowel bij de eindverpakking die de consument ziet, als de processen die het product daarvoor doorloopt. Uitdagingen en mogelijkheden in verpakkingsdesign Hoewel Horizon dus een stuk flexibeler is door het aanpassen en in beheer nemen van de verpakkingen, zorgde dit er ook voor dat er veel opnieuw getest en geprobeerd moest worden. Klaas legt uit dat de voornaamste uitdaging zat in het afstemmen van de hoeveelheid product met de grootte van de verpakking. Horizon onderscheidt zich namelijk al jaren door verschillende verpakkingsmaten aan te bieden, zo vertelt hij. Met name in het segment van de kleinverpakkingen van biologische noten, zaden en zuidvruchten is Horizon uniek: de hoeveelheden van 150, 400 en 800 gram zijn interessant voor verschillende doelgroepen. “Bij het testen van de verpakkingen hadden we niet in één keer de juiste verhouding te pakken: dan weer zat er te weinig product in de stazak en was er te veel verpakking, dan juist weer te veel product. Nog los van het passen en meten van de consumenten eenheden in de juiste buitenkartons en de ideale stapelverhouding op de pallet. “Jeffrey en Raymon zijn als operators verantwoordelijk voor de verpakkingslijn en hebben de afgelopen periode ontzettend hard gewerkt. Het is fijn om betrokken medewerkers met veel technische expertise in huis te hebben”, aldus Klaas. Uiteindelijk is het na een aantal keer proberen gelukt om de juiste verhoudingen te vinden voor alle producten die we in de stazakken aanbieden”. Horizon is echter nog lang niet klaar met innoveren, juist door de verpakkingslijn zien ze nieuwe mogelijkheden – zowel binnen, als buiten Nederland. “Met deze verpakkingslijn wordt het beter mogelijk te innoveren in producten: we zouden nu bijvoorbeeld makkelijker mixverpakkingen aan kunnen bieden, dus met verschillende noten, zaden en zuidvruchten in één” gaat Klaas verder. “Daarnaast kunnen we in landen buiten Nederland makkelijker uitbreiden. Ons merk Monki is bijvoorbeeld in een groot deel van Europa al bekend vanwege de notenpasta’s. Op termijn zouden onder dat merk bijvoorbeeld stazakken met biologische noten, zaden en zuidvruchten bij kunnen komen. Zo is er een vertrouwd en geliefd merk in die gebieden, met een heel ‘nieuwe’ lijn.” Klaas geeft vervolgens aan dat men bij sowieso altijd bezig met het verbeteren van producten en het bedenken van nieuwe concepten. “Dat blijven we ook doen. We zitten boordevol met nieuwe ideeën om de komende jaren uit te werken en te lanceren. Tegelijkertijd blijft Horizon tijdloos en concessieloos. We houden vast aan onze idealen en zijn daardoor betrouwbaar. Dit spreekt mij persoonlijk aan, maar we zien het ook terug in het vertrouwen en de waardering die we van onze klanten krijgen.”

02 november 2023

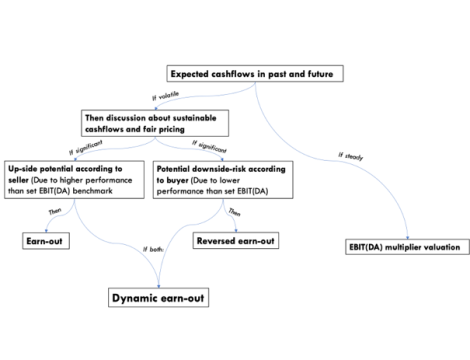

Dealing with volatile EBITDA-levels in company Valuations: (Dynamic) earn-outs in Private Equity This article is part of a series of short LinkedIn blogs by the Food & Agri team of Anders Invest. Here we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. In fast-paced markets with heightened uncertainty, accurately forecasting returns and valuing companies has become increasingly challenging. In a stable market environment with a steady EBITDA, valuing a company is often more straightforward—a multiplication of EBITDA by a fair multiple often provides the answer. However, when faced with an uncertain market environment and fluctuating EBITDA due to macro events like COVID-19 or geopolitical conflicts such as the war in Ukraine, accurately determining a company's value becomes more complex. We would like to outline a dynamic earn-out structure that we employ to deal with the abovementioned dilemmas. A creative deal structure that caps both upside potential and downside risk assuring a fair price for the seller and buyer. Let’s delve into the story of EcoBite, a fictitious company dedicated to delivering organic foods that serves as a dummy for an Anders Invest acquisition. During COVID-19, EcoBite’s performance increased substantially due to home-delivery demand. The company had an EBITDA of €6M in both 2020 and 2021. However, due to inflation and other macro-economic events, the company faced issues from both demand and supply side. This resulted in an EBITDA of only €3M in 2022. These unanticipated fluctuations in performance prompted EcoBite and Anders Invest to reevaluate their strategies and investments decisions. The owner of EcoBite valued the company using a €6M EBITDA claiming that the lower result was an isolated event and that would soon jump to 2020/21 levels. From our perspective, the uncertainty was too high, and we claimed a valuation based on €3 million EBITDA when looking at the performance of 2022. Realistically, the fair valuation lies somewhere between these numbers, but future performance is difficult to predict and sustainable cashflows cannot be assumed. As a result, we established a valuation benchmark at €3.5M, positioned between the specified numbers. To address the possibility of increased performance beyond the €3.5M EBITDA benchmark for the seller, the earn-out agreement enables additional returns if the results surpass this benchmark over the next three years (starting from 2023). In that case, we will pay the difference between the benchmark EBITDA and the actual realized EBITDA. This mechanism helps to capture the upside potential for the seller when performance is high. However, to address the possibility of lower performance than the €3.5M EBITDA benchmark and mitigate potential downside risk, the structure safeguards us by granting additional shares of the company or a cash pay-back. This type of earn-out is referred to as a dynamic earn-out. This way, we can still promise our investors a fairly predictable return since both the downside risk and upward potential are partly capped. Even if there is high uncertainty and it is difficult to predict future cash flows, this arrangement allows us to keep doing fair transactions for both the seller and our investors in a volatile and uncertain market. A creative structure that is beneficial for all parties involved. *In the past, we have successfully implemented this structure in real-life situations, customizing it to align with the distinct requirements and preferences of the selling shareholders. This framework offers the flexibility to opt for either a cash earn-out or a share redistribution. Additionally, it provides multiple payout and share redistribution scenarios that are contingent on the future performance of the company.

09 oktober 2023

Pioneering Sustainable Grain Trading: The Journey of Spartac Chilat and Prograin This article is part of a series of interviews by Anders Invest's Food & Agri team. Here, we look at people and activities from our portfolio companies. In this interview, we meet Spartac Chilat, the founder and CEO of Prograin Organic. A company that operates in the field of cultivation, processing, storage, trading and export of organic grains, seeds, and pulses in the Republic of Moldova. They were the first company to introduce organic food and agriculture in Moldova and help farmers transition from conventional to organic practices. History of Spartac and Prograin Spartac has been involved in the food and agriculture industry since graduating from the Academy of Economic Studies of Moldova in 1997. Throughout his career, he held several positions with agricultural companies; focusing on the distribution, logistics, and trading soybeans, fertilizers, and grains across Moldova. What truly captivated him was the concept of uniting farmers and integrating them into a cooperative network. Leveraging his industry knowledge and network of distribution partners, buyers, and farmers, Spartac identified a promising opportunity in the grain trading industry in 2012, leading to the establishment of Prograin. Together with four former colleagues, he started his new venture. Having an in-depth understanding of conventional farming, Spartac was aware of its flaws. Fueled by a conviction to harness the full potential of Moldova's fertile landscape, he observed that ordinary operators lacked respectful land treatment, leading to reduced long-term fertility. The increasing use of chemicals and fertilizers deteriorated the ground and raised concerns about public health. Furthermore, competing in conventional farming against larger operators who used cost-leadership strategies posed obstacles with low margins, often undermining and eliminating smaller players. Therefore, Spartac recognized to take a more holistic view and initiated a transition to organic production in 2015 with Prograin. During this time, he met Dirk and Michel, his first Dutch connections, who were crucial in establishing the foundation for a later partnership with Anders Invest. "Prograin is deeply committed to aiding farmers by providing input supplies, certification, technological support, grain handling, logistics, legal assistance, and other essential activities. These endeavours, although crucial, require upfront investments. A significant challenge to note is that 80% of farmers struggle to make these initial investments without a direct return. This calls for a shift in mindset. Due to the sustainability aspect of our business, it's crucial to transition from short-term thinking to a long-term approach. While an investment today might take longer to realize profitability compared to conventional farming, with patience and understanding, it will ultimately become highly lucrative. This is not just due to enhanced soil health but also because of the opportunity for premium pricing. For a truly sustainable future, collaboration is vital. As we've always believed, "You cannot be sustainable if your partners are not sustainable." Together, with a united vision, we can ensure that both the land and our farming partners thrive." Anders Invest saw this niche market's favourable business climate and high growth potential in Moldova. Spartac explains: "Anders Invest brings their extensive expertise in food and agriculture, along with a long-term vision. We knew this was the perfect opportunity to start making a difference within the industry." Unique Value proposition of Prograin Prograin operates throughout Moldova's entire value chain of organic grains, seeds, and pulses. "We are dedicated to supplying high-quality organic products with complete traceability, ensuring a seamless journey from the field to the consumer's plate." Prograin ensures efficient collection and storage logistics and has invested in state-of-the-art organic processing lines. This commitment to infrastructure development allows Prograin to access organic grain markets effectively. They are Moldova's first IFS (International Featured Standards) certified company. Prograin's commitment to quality control ensures that products meet rigorous standards before export. They promote various crops, including spelt, wheat, oat, sunflower, corn, sorghum, mustard, green pea, yellow pea, soybean, rye, beans, alfalfa, and buckwheat. On top of that, they started the Moldova Organic Value Chain Alliance (MOVCA). An NGO that supports the growth and success of organic agriculture throughout Moldova and actively advocates for subsidies and pro-organic policies with the government. A bright future ahead The future of Prograin appears promising as organic production gains importance in the agricultural landscape. Spartac envisions significant growth driven by crop rotation, regenerative farming, and subsidies for green initiatives. The company invests in soil fertility programs to boost yields and increase profitability. Growth rates of more than 10% per year are anticipated as Prograin continues to navigate and excel in these different facets of the business. In conclusion, Spartac Chilat's journey in the food and agriculture industry has culminated in the establishment of Prograin, a pioneering force in Moldova's agricultural landscape. His vision of becoming a market leader and fostering a cooperative network among farmers has driven Prograin's success and has only just started. With the strategic partnership with Anders Invest, Prograin has a bright future, aiming to expand its reach and connect with more farmers while ensuring high-quality products and complete traceability from field to plate.

21 september 2023

Green Growth: Strengthening Organic Agriculture with Regenerative Practices for a Sustainable Future This is the first of a series of short blogs by the Food & Agri team of Anders Invest. Here, we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. Climate change presents challenges to humankind, with a variety of notable impacts across the globe, such as receding ice caps and severe weather occurrences. Food and agriculture have the potential to contribute positively to climate change mitigation. As stated by the UN, approximately 40% of the Earth's land is currently degraded, with the possibility of depleting our topsoil in around 60 years. In this Blog we investigate the potential of regenerative and organic farming to combat the adverse climate effects of agriculture and how we try to implement this at our portfolio company in Moldova: Prograin Organic. Organic and regenerative farming are both sustainable farming methods that have the potential to complement each other for even greater sustainable benefits. Regenerative agriculture is gaining momentum in recent years; by focusing on restoring soil health, enhancing biodiversity, and sequestering carbon, it aims to create a resilient and productive agricultural system. However, regenerative agriculture currently lacks universal definitions, practices, regulation, and supervision to have a consistent impact. Organic agriculture, through a certification system, does have universal definitions, practices, regulation, and supervision. However, it is relatively narrower than regenerative farming as it primarily focuses on avoiding synthetic chemicals and promoting natural inputs. We aim to combine the best of both worlds; that organic farming can be complemented with regenerative farming practices, specifically focusing on promoting the regenerative properties of soil. “At Anders Invest, we endorse organic as a dependable sustainability standard, while striving to surpass it by promoting regenerative practices in our portfolio companies. For instance, our Moldovan company, Prograin Organic, assists conventional farmers in transitioning to sustainable farming methods by providing organic fertilizers that boost soil regeneration. We pursue this approach not only to generate a positive impact but also to secure long-term financial returns through increased yields and improved crop quality” comments Jurjen van der Werf (Investment Manager at Anders Invest).

20 juli 2023

From Yuck to Yum: The Growing Potential of the Edible Insect Market Our second short blog by the Food & Agri team of Anders Invest! Here, we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. In 2018, the European Union approved the use of insects as a food source, marking a significant breakthrough in the food industry. In May 2021 the European Commission granted its first authorization for an insect based food product, approving the dried mealworm as a safe food ingredient. There are still some hurdles to overcome before edible insects are broadly consumed and accepted, but we anticipate widespread adoption and increasing growth in the next years. Edible insects offer numerous benefits; however, some unfounded concerns about their safety exist. Online reports suggest that insects are non-digestible and could cause cancer, making some individuals hesitant to consume them. These misconceptions contribute to the existing stigma associated with eating insects, often referred to as the "yuck factor," which further discourages consumers from trying these alternative food sources. Recent studies have refuted these concerns, demonstrating that edible insects are not only nutritious but also safe to eat. While it's true that some parts of insects are non-digestible, these components act as sources of fiber, aiding digestion like whole grain bread, beans, and seeds. Before granting approval, regulatory authorities like the European Union thoroughly assess the safety of edible insects for consumption. Moreover, around 2 billion people worldwide already incorporate insects into their diets regularly. Although the edible insects market is still relatively small, it is poised for rapid growth as awareness of their benefits spreads and the "yuck factor" diminishes. For instance, the global mealworm market is forecasted to hit $1.27 billion by 2030, exhibiting a compound annual growth rate of 28.6% from 2022 to 2030. We believe that the path to success for businesses in this market depends on optimizing farming operations to reduce costs while enhancing quality. The promising market potential and its unique market position are the two main reasons for Anders Invest Food & Agri to invest in Starfood Holland. As a European market leader in mealworm farming for the food and feed industry, Star Food operates a large-scale insect farming facility in Hungary. Together with VDL Groep, Star Food recently developed a customized feeding line to further automate mealworm farming, effectively reducing marginal costs while ensuring high quality. Robust market growth isn't the sole factor driving Anders Invest's entry into the mealworm market. Mealworm proteins offer a more sustainable alternative to many traditional protein sources, such as meat. Stay tuned for our next LinkedIn blog, where we'll dive deeper into this topic.

20 juli 2023

Feeding the World: A Perspective on Sustainable and Affordable Food This article is part of a series of short blogs by the Food & Agri team of Anders Invest. Here, we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. As the world's population inches closer to 10 billion, the escalating food demand is unignorable. To meet this, global food production must ramp up by 50-70%, a challenge intensified by the 2.3 billion individuals already grappling with food insecurity. In addition, there is the simultaneous necessity to mitigate climate change impacts, underscoring the dual challenge of affordability and sustainability that more and more defines the food and agricultural sector. The challenge is that we’re trying to feed the growing world population while also needing to take care of our climate and all the different kinds of life on our planet. This situation has led to two different ways of thinking: agroecology and ecomodernism. Agroecology supports sustainable food production, leaning towards organic farming that takes care of the soil, clean water, biodiversity, and nutritious food. On the other hand, ecomodernism focuses on using technology and producing a lot of food on a small piece of land, suggesting a strict separation between farmland and other ecosystems where nature can flourish. Strike the right balance between satisfying the imperative demand for accessible food and tackling the pressing issue of climate change, and you'll find yourself caught in the midst of a high-stakes struggle. Volkert Engelsman, the founder of Eosta BV / Nature & More, simplifies this complex dilemma: “We are losing 30 soccer fields of fertile land every minute, profit can only be profit if it doesn’t jeopardize people and planet. While affordability is undeniably vital, it is equally important that we conduct comprehensive calculations that account for both the positive and negative externalities associated with nutritious food, social inclusion, and ecosystems.” Nevertheless, Hidde Boersma, in his thought-provoking piece for the Correspondent, sheds light on the ecomodernist view: “Through the adoption of intensified farming techniques, we possess the capacity to free up farmland spanning the entirety of Russia. This staggering feat can be achieved by harnessing the power of a 25% boost in crop productivity.” Boersma passionately argues that this preserved land, no longer under the plow, could be transformed into thriving natural ecosystems, becoming havens of biodiversity and environmental balance. However, Boersma's ideas regarding factory farming rest upon a set of assumptions that blur our understanding of ecosystems and microbiomes, misrepresenting their true workings. An oversimplification of nature allows for easy commodification and scalability but diminishes the intertwined complexities that constitute as nutritious food utilizing only a fraction of the required DNA of plants and neglects the importance of sunlight and instead using LED lighting. At Anders Invest Food & Agri Fonds, we understand that a one-sided approach risks overlooking the intertwined complexities of social development and environmental sustainability. In the short-term, there is a contention that a solely organic system lacks affordability for all, without taking into account negative externalities such as the increasing healthcare costs associated with food-related diseases, water pollution, and nitrogen intensification. Conversely, an excessive focus on agricultural intensification disregards environmental considerations, biodiversity depletion, water pollution, and the potential dependency of developing countries on western technology. As we analyze the crux of the matter, a distinct pattern comes into focus. It becomes increasingly apparent that the organic system exhibits minimal to no yield loss for fruits, while grains suffer a more substantial decline. Considering this significant revelation, we propose a focused strategy: let us channel our efforts into cultivating fruits using entirely organic methods, effectively demonstrating the positive impact on consumer prices while the lower yields justify a slight premium for the grains. After all, to provide affordable and organic sustenance for our rapidly growing global population, it is imperative that we address the global power dynamics within the food and agriculture sector. This involves reducing the substantial portion of land currently allocated to animal production, which currently stands at 70%, and prioritizing the availability of nutritious food worldwide. We will dive into these subjects in a later blog. Stay tuned!

20 juli 2023

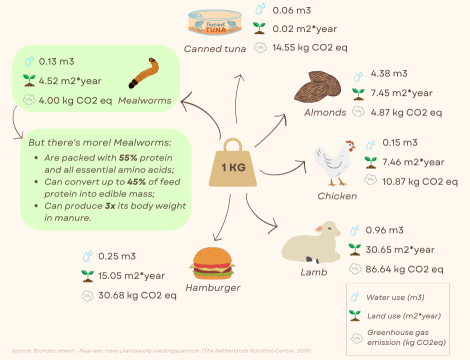

The Future of Protein: Harnessing the Efficiency and Sustainability of Mealworm Production This article is part of a series of short blogs by the Food & Agri team of Anders Invest. Here we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. In our previous article about mealworms (find it here), we debunked the notion that mealworms are a harmful food source. We underscored the significant role they can play in enhancing diet quality, given their robust protein profile - a whopping 55% - and their completeness in supplying all essential amino acids. Previously, mealworms were largely reserved for animal feed. However, the recent years have seen a shift in their role towards human food, with the EU allowing the use of mealworms for human consumption. This broadens the horizon for mealworms, as they are poised to shape the future of nutrition for both animals and humans. What makes this even more exciting is that the merits of mealworms extend beyond dietary health—they also stand out as a remarkably sustainable alternative to traditional protein sources. For instance, these insects leave a significantly smaller carbon footprint, require less water, and are not as land dependent. The figure below offers a comparative overview of different protein sources, highlighting the superior sustainability metrics of mealworms. The realization of these sustainability benefits hinges critically on the price-competitiveness of mealworm proteins against alternative protein sources, particularly with regards to animal feed. As such, we're of the view that for companies in the mealworm farming sector, their right to win lies in their ability to operate at comparatively low marginal costs while upholding a consistent, high-quality protein yield. Our portfolio company, Starfood Holland, has a leading position in the mealworm farming market. As founder and co-owner Wim Soetendaal explains: “With our partly automated farming operation in Hungary we have the scale and efficiency to produce at a competitive marginal cost while ensuring consistent quality. In addition, we pelletize the mealworm manure and use these pellets to generate the energy to maintain the farms at optimal farming temperature. As such, we further reduce the marginal costs”. In conclusion, mealworms mark a pivotal shift in the protein industry, both nutritionally and sustainably. The success lies in efficient production, as demonstrated by our portfolio company, Star Food. Their innovative approach is helping to shape a more sustainable Food & Agri sector. Stay tuned for more insights and developments from Anders Invest as we continue to navigate the dynamic landscape of this industry.

20 juli 2023

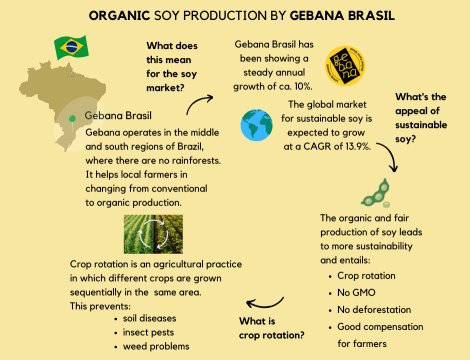

Sustainable Soy: Balancing Demand and Environmental Responsibility This article is part of a series of short blogs by the Food & Agri team of Anders Invest. Here we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. The popularity of soy-based products has been steadily increasing for years. Soy is a versatile legume that is used not only as a meat substitute in products like veggie burgers and vegan chicken, but also as a source of protein for livestock and farmed fish. A big part of the soy production occurs in Brazil, Argentina, and the United States, where the favourable climate allows for high crop yields. Within Europe, the Netherlands is the largest importer of soy, importing 2.51% of all soy, worth 2.19 billion dollars. Thus, soy is big business in our country! The cultivation of soy, however, has a dark side which can be most clearly seen in Brazil and is caused by three things mostly. Firstly, vast forest areas have been cleared to make way for soy fields, resulting in a significant loss of biological CO2 sequestration. This has detrimental consequences for global warming and biodiversity, as the rainforest is needed to reduce CO2 in the environment and houses a large variety of flora and fauna. Secondly, the use of pesticides and imported fertilizers in soy cultivation has raised concerns about environmental sustainability, as because it can lead to water pollution, for example in rivers and lakes surrounding the soy fields. Lastly, instances are known where farmers producing soy have been exploited and pushed excessively to get the most out of their land. Apart from this, local tribes that rely on the rainforest are being threatened in their survival. Since the Netherlands plays a big role in import and export of soy, this also comes with a responsibility to make sure the soy is of good quality and not a product of harmful malpractice to nature or the local population. The good news is that there are local initiatives that see these problems and that strive to produce soy in an environmentally friendly way, while also taking into consideration the wellbeing of farmers producing the crop. One of the companies taking initiative is Gebana Brasil, one of our portfolio companies at Anders Invest. They are contributing by promoting and processing organic, non-genetically modified soy and other grains and seeds, as well as fair compensation for farmers. Saskia Korink, investment director for Anders Invest, explains the approach of Gebana further: “Organic soy production also entails crop rotation. This means that a different crop is growing on a particular piece of land each growing season. This is very useful to prevent soil diseases, insect pests, weed problems and to build healthy soils." To drive significant change in the sustainability and ethics behind soy cultivation, it is important to look beyond well-known institutions like legislators and policy makers and support local endeavours that bring about tangible impact, mitigate deforestation, and pave the way for a genuinely sustainable future.

20 juli 2023

Bart Leemans‘ Vision for Service2Fruit: Redefining the Fruit and Vegetable Industry Background in the Food and Agri Sector Bart's career began in the international hospitality industry after completing his studies at the Maastricht Hotel School. After his studies he found himself on a new trajectory, transitioning to commercial roles within the food industry. When he became the commercial director for Fruitmasters and Koppert Cress, he used his knowledge from the hospitality industry to take advantage of input markets (such as ingredient) that supply restaurants and hotels. Next to his commercial activities he wants to drive positive change and leave this world as a better place. At S2F Bart found the perfect combination where he embraces the companies mission: “Always a fair deal.” Experience as Director As the new Director of Service2Fruit, Bart quickly adapted to his role and found satisfaction in overcoming new challenges. Building relationships, understanding team dynamics, and engaging stakeholders have been paramount in his early days. Bart utilizes his network to uncover opportunities and create mutually beneficial outcomes. He believes in empowering people; allowing them to make mistakes while being held accountable. In his own words, he adheres to the principle of being "rigorous when it comes to the quality of the content and compassionate towards the people involved.", Bart experiences some reservations regarding traditional titles such as CEO or Director, perceiving them as somewhat antiquated. He places more importance on being evaluated based on how people perceive him rather than being defined by his title. Service2Fruit S2F aims to foster direct communication between growers and buyers, creating a fair trading platform that benefits everyone involved. The platform offers four essential services. Firstly, it ensures transparency in the value chain by publishing all transactions (incl. prices, and quantities). Secondly, the cost of using the platform is a fixed commission per KG (as opposed to a % of the value), which means the platform has no incentive to influence prices. Thirdly, through an escrow account the platform provides financial security. As a grower or buyer, you either have money or product. Finally, S2F has an experienced and independent team of trade experts that facilitate deals on the platform. With these benefits, Bart explains that it is more beneficial to work with S2F: “In the agricultural sector, while ample product knowledge exists, navigating sales strategies for growers can be challenging. After initial sales have been conducted, a surplus is left for the farmer. They face the choice of establishing their own sales mechanism through a commission agent, cooperation, an auction, or to us! At S2F, we believe in transparent value chains, ensuring fair market prices for producers while minimizing unnecessary costs imposed by intermediaries. It is a widely acknowledged that intermediaries often claim a significant portion of the value, but our mission is to foster a more balanced distribution within the supply chain. Our track record substantiates this approach and shows the added value compared to traditional sales mechanisms: Through our platform, growers on average enjoy higher average kilo prices compared to traditional channels.” As a result, Quite often Service2Fruit is leading in setting the market price for Conference pears. Future Plans and Goals The value proposition of S2F has many advantages, as evidenced by positive feedback and sales. In light of this, Bart has set two ambitious goals for the future of S2F. His first goal is to prioritize promotion and widespread availability of the S2F platform. To do this, he works together with organizations of fruit growers and collaborates in both local and international markets, specifically for hard fruits. A good example of this is the recent collaboration with the fruit auction Zaltbommel (follow link here). Bart understands that it's not easy to get people interested in something new, so he emphasizes the importance of making people aware of the platform. He aptly captures this sentiment by stating: "unknown makes unloved." His second goal is to leverage the platform to expand into new markets and explore opportunities in different product groups. To accomplish this, it is crucial to identify markets that share similarities with the hard fruit market. Markets that benefit from transparency, security of payment, and independent expertise from an external sales team are ideal fits for the platform. Examples of comparable dynamics include flower bulbs, potatoes, and onions. With the support of Anders Invest, Bart sees endless possibilities for national and international expansion: “The goal is to become the Bol.com of the fruit and vegetable sector.” Conclusion Under the leadership of Bart Leemans, S2F is infused with a fresh wave of enthusiasm and commitment to establishing a fair and transparent market for growers. Bart's ambition and vision foresee limitless opportunities for the platform to expand and generate exceptional financial returns. By making strategic investments and capitalizing on the boundless possibilities, S2F aims to redefine the fruit and vegetable industry.

29 juni 2023